Credit matters more than it did 20 years ago.

Why does your credit score matter more than it did 20 years ago? Because more and more businesses are using it to sell, hire and rent to people. Nowadays, some companies check the credit score of an interviewee before they even hire them. In today’s interconnected global market, your credit worthiness can directly affect your quality of life or the success of your business for that matter

Not only is good credit essential for obvious things like qualifying for a loan or getting a credit card, but also for less obvious things like getting cellular telephone service, renting a car, and even getting a low insurance premium.

Managing your credit will also help you save for a rainy day. A strong credit history, reflected in good credit scores, will let you qualify for lower interest rates and fees, freeing up additional money to set aside for emergencies, retirement, and other smaller unexpected expenses. Decreasing debt and increasing savings reduces stress and leads to greater financial freedom.

Managing your credit will also help you save for a rainy day. A strong credit history, reflected in good credit scores, will let you qualify for lower interest rates and fees, freeing up additional money to set aside for emergencies, retirement, and other smaller unexpected expenses. Decreasing debt and increasing savings reduces stress and leads to greater financial freedom.

The good news is that having good credit is not difficult. Simply follow these five fundamentals of good credit management and you will build and maintain a credit history that will enable you to get the credit you need, when you need it.

5 Tips for Building Good Credit

1. Establish a credit report

To establish a credit report you must have an open, active credit account. To get your first credit account talk to your bank or credit union.

2. Always pay as agreed

Make at least the minimum payment due each month and never be late. Delinquent payments and payments that don’t meet at least the minimum contractual amount will have the most immediate, negative impact on your credit report and credit scores.

3. Keep your balances low

Keeping your balances low as compared to your available credit limits is a sign of good credit management and shows lenders you are a good credit risk. Your utilization rate, also called your balance-to-limit ratio is a key component to credit scores.

4. Apply for credit wisely

Do not apply for multiple accounts in a short period of time. Taking on large amounts of debt in a short time is a sign of high credit risk. Apply for credit when you need it, and only in the amount you need. Just because credit is offered, doesn’t mean you have to accept it.

5. Demonstrate good credit habits over long periods of time

In order to have good credit scores you must demonstrate a habit of good credit management over a long period of time. That means making all payments on-time, not using more than 25% of your available credit at any given time

Is Credit Repair a Good Idea?

Every day, companies target consumers who have poor credit histories with promises to clean up their credit report so they can get a car loan, a home mortgage, insurance, or even a job once they pay them a fee for the service. The truth is, these companies can’t deliver an improved credit report for you using the tactics they promote. It’s illegal: No one can remove accurate negative information from your credit report. Only time and your effort can fix your credit.

Borrowing money is the easiest way to establish a credit history and have a favorable credit score. Even if banks are reluctant to give you a credit card, you can always put money in a prepaid credit card and build your credit overtime by managing the prepaid card.

Credit Score

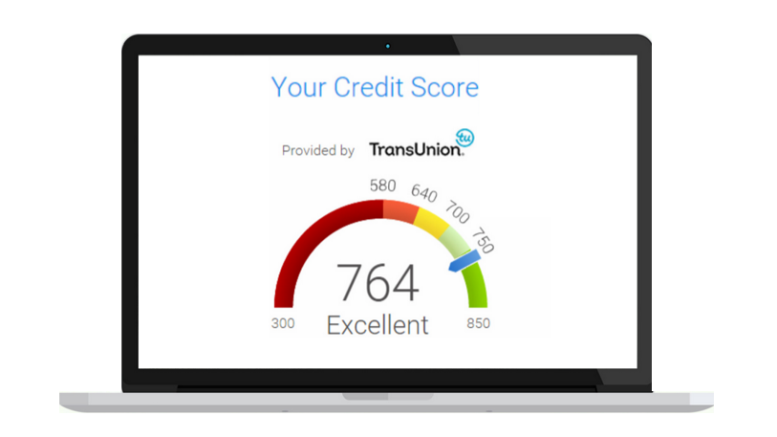

Credit scores range from 300 to 850. Most people’s score is 600 to 800. A credit score of over 720 is considered to be a good score and will generally get you the best interest rate.

There are three companies that provide credit scores, Equifax, TransUnion, and Experian. They are corporations that make their money, not directly from the consumer, but from companies such as banks, that loan money to people. Each of the three allows you, the consumer, to receive a free credit report annually. But, it’s only done upon request.

It’s wise to check your credit score yearly with one of the three credit reporting companies. When you receive your report you want to first, review it carefully and see if there are any errors or flaws. For example, if the report shows an old unpaid balance on your Target credit card, you’ll want to contact Target, and get that corrected.

You should not close any unused accounts. This may go against your better judgment. But, closing credit card accounts, especially more than one at the same time, could be a red flag that you might be a credit risk.